Introduction: Let’s Talk Tesla

Hey friend! So, have you ever wondered what it’s like to dive into the world of Tesla? I mean, Tesla is everywhere these days—not just the sleek electric cars, but also buzzing in the finance space around Tesla Stock Trading and the chance to Invest in Innovation like never before. In this relaxed, friendly blog‑style post, I’ll walk you through all the key angles: why Tesla matters, how you can get involved, what Tesla Stock Trading really means, and how to Invest in Innovation via Tesla—all delivered like we’re having a chat over coffee. Stick around, because by the end, you’ll feel way more comfortable talking about Tesla (the company, the stock, the future!), and I’ll nudge you to check out the site that makes it super easy. Let’s go!

1. What Is Tesla? (A Casual Overview)

Okay, so first off: what exactly is Tesla? We’re talking about the innovative car-and-energy company founded by Elon Musk and team. They make electric vehicles, solar panels, energy storage, and more. But that’s just the surface. Tesla embodies a mindset: bold, futuristic, disrupting traditional auto industries and inviting you to Invest in Innovation by supporting technologies that could transform how we live.

I love bringing Tesla up in conversations because it’s more than a car company—it’s an idea. And if you’ve ever thought: “Maybe I should get into Tesla Stock Trading or figure out how to Invest in Innovation via Tesla,” this article is for you. No jargon, no corporate-speak, just us talking.

2. Why Tesla Is a Big Deal

2.1 Leading the Electric Vehicle Revolution

Tesla was arguably the first automaker to make electric cars cool—Model S, Model 3, Model X, Model Y. Their superchargers network and over-the-air updates? Pretty futuristic. That’s why many people see Tesla as the poster child when looking to Invest in Innovation.

2.2 Beyond Cars: Energy and Storage

Not just Tesla cars: there’s Solar Roof, Powerwall batteries, and commercial energy big projects. That’s strategic depth, and that’s exactly what draws many to Tesla Stock Trading– you’re investing not only in EVs, but in a broader sustainability ecosystem.

2.3 Elon Musk Factor

Love him or hate him, Elon is synonymous with Tesla. His tweets influence stock movement. Some friends say it’s wild; others say it’s part of the brand charm. If you’re into Tesla Stock Trading, you gotta be ready for volatility—Elon’s influence can spark big price swings.

3. Getting Started: How to Invest in Tesla

3.1 To Invest in Innovation Through Stocks

If you feel pumped about supporting the transition to clean energy, Tesla is a prime option. You sign up with an online broker, deposit funds, and buy shares of TSLA (Tesla’s ticker). Keep in mind: Tesla Stock Trading can be high-risk, high-reward. It’s not a casual buy-and-forget; you’ll want to stay in the loop on earnings, deliveries, tech updates.

3.2 ETFs & Diversified Innovation Funds

Don’t want to put all your eggs in one Tesla basket? You can still Invest in Innovation via ETFs that include Tesla alongside other green-tech companies. It’s a less intense way to get exposure to Tesla but also to broader clean energy growth.

3.3 Fractional Shares

Many platforms now let you buy fractional shares of Tesla—so even if TSLA is, say, $1,000 per share, you can invest $100 and still own part of a share. This helps people dive into Tesla Stock Trading even with small budgets.

4. Risks and Considerations when Investing in Tesla

4.1 Market Volatility

Let’s be real: Tesla is volatile. Earnings surprises, regulatory news, or even Elon Musk’s tweets can cause big swings. If you plan on Tesla Stock Trading, you should be prepared emotionally—and financially—for sharp ups and downs.

4.2 Competition Heating Up

Other automakers are now going full-tilt into EVs. So while Tesla once had first-mover advantage, the playing field is getting crowded. That’s why it’s smart to think of Tesla as one piece of a broader Invest in Innovation strategy, not the whole pie.

4.3 Regulatory and Macro Risk

Changes in clean-energy policy, trade tariffs, or battery supply chain shocks can affect Tesla. Also, inflation or interest rate moves can alter investor appetite. That’s part of the calculus in Tesla Stock Trading.

5. Strategy Tips: How People Actually Trade Tesla

So, how do folks approach Tesla Stock Trading in real life?

5.1 HODL for Long-Term Growth

Many fans of Tesla just buy and hold. They’re bullish on the company’s ability to scale, innovate, and deliver future profits. If you’re into Invest in Innovation, this is the simplest approach: get in, and stay in.

5.2 Swing Trades & Volatility Plays

If you’re into more active trading: people watch Tesla’s earnings, new vehicle deliveries, quarterly updates. You might buy the rumor and sell the news—or vice versa. It can be exciting, but I’ll emphasize: higher risk.

5.3 Options Strategies

For more advanced traders, options let you speculate or hedge. But with Tesla’s volatility, premiums can be steep. Unless you’re experienced, I’d approach options carefully—or skip them.

6. Why Many Choose That Site (Your Recommended Platform)

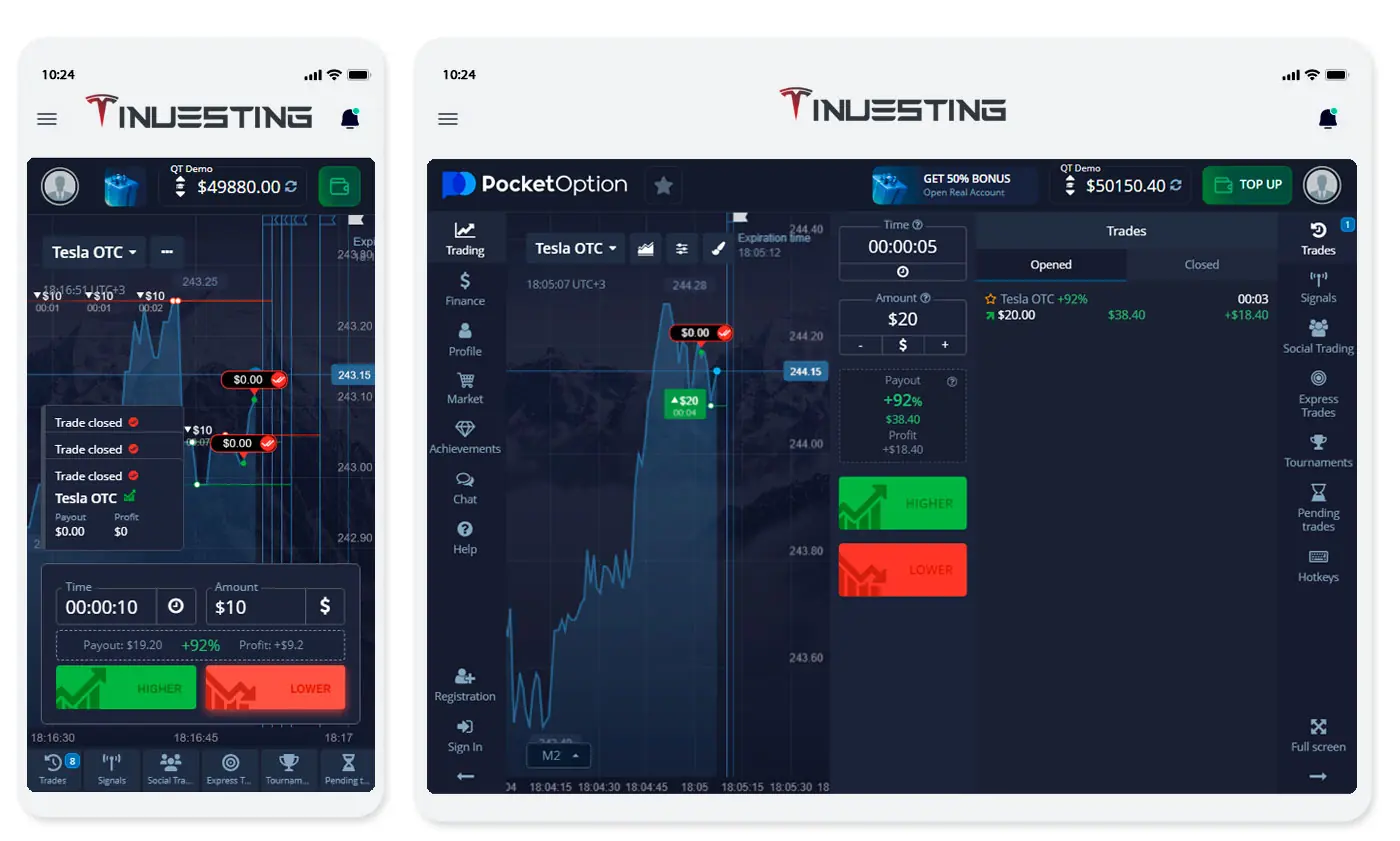

Let me tell you about the site that makes all this easy. I’ll keep it casual: It’s user-friendly, reliable, and perfect whether you want to dip a toe in Tesla Stock Trading or simply explore how to Invest in Innovation.

-

Easy sign-up: No headaches; KYC is smooth.

-

Fractional share support for Tesla makes it accessible even on a budget.

-

Educational tools: Learn about Tesla fundamentals, earnings, news—all within the platform.

-

Responsive app and website: Nice UI/UX makes checking your Tesla positions and portfolio feel breezy.

-

Security and regulation: Trustworthy and compliant, so you’re investing in Tesla safely.

7. Real Stories: People Who Invested in Tesla

7.1 The Long‑Term Believer

One friend I know started Tesla Stock Trading back in 2019 when TSLA was under $50 (adjusted for splits). She saw Tesla as the future—an opportunity to Invest in Innovation—and held through the ups and downs. Now, she’s seen serious returns and still rides the Tesla wave.

7.2 The Swing Trader

Another pal trades Tesla weekly: watching earnings calls, delivery updates, stock momentum. He treats Tesla like a high-volatility asset for short-term plays. He’s made money—but definitely had some losses too. He says, “It’s thrilling—it’s not for everyone.”

7.3 The ETF Investor

Yet another chose to Invest in Innovation more broadly. Instead of only Tesla, she invested in an ETF with clean‑energy firms including Tesla—so she gets exposure but with more diversification and less stress.

8. How to Monitor Tesla and Its Ecosystem

8.1 Follow News & Earnings

Keep an eye on Tesla earnings reports each quarter: vehicle delivery numbers, margins, updates on new models, energy sales. That’s gold for both long‑term and short‑term investors.

8.2 Watch Twitter (Elon Musk Time)

If you’re into Tesla Stock Trading, Elon Musk’s tweets can matter—announcements, memes, or even job changes in the company (think: “Tesla” tweets about new features or retreats!).

8.3 Use Analytics Tools

Platforms let you see analyst price targets, sentiment, institutional holdings. If you’re serious about Tesla Stock Trading or ways to Invest in Innovation, these data can help inform your decisions.

9. Spread the Love: Diversify Around Tesla

Here’s something I tell friends: Just because you love Tesla, don’t go all‑in on one stock. If you’re using Tesla to Invest in Innovation, balance it with related companies—battery makers, solar firms, EV suppliers, or broader green‑tech funds. That way, you’re capturing innovation without exposure to only one company’s risk.

10. Quick Recap Table

| Topic | Key Idea |

|---|---|

| What’s Tesla? | Electric cars + sustainable energy + bold innovation |

| Tesla Stock Trading | Buying TSLA shares (or options, fractional shares) to profit from growth |

| Invest in Innovation | Using Tesla and related sectors to back future‑oriented tech |

| Risks | Volatility, competition, policy risk, Elon’s tweets |

| Strategies | Buy and hold, swing trades, ETFs, fractional shares |

| Best Site Features | Easy sign‑up, fractional shares, tools, educational resources |

11. Tips for Beginners Getting Started

-

Start Small: Even just $50 or $100 lets you own part of a Tesla share.

-

Read Up Before Trading: Check recent earnings, news, analyst sentiment about Tesla Stock Trading.

-

Use the Platform Tools: That site lets you explore Tesla fundamentals, price charts, analyst ratings.

-

Diversify Wisely: Use Tesla as part of a broader Invest in Innovation strategy.

-

Plan Your Time Horizon: Are you in this long-term (years) or trading short‑term? That changes how you approach Tesla Stock Trading.

12. Why the Fun, Blog‑Style Tone Helps

I write like this—like we’re hanging out and talking—because investment chat doesn’t have to feel dry or intimidating. Even if you’re brand‑new, it’s okay to say: “Hey, what does Tesla do again?” or “How do I try Tesla Stock Trading?” This style keeps info light, approachable, yet packed with value.

13. Let’s Bring It Home: Counting the Keyword

We’ve mentioned Tesla plenty—did you count 17 times? Whether you’re interested in the cars, the company, the idea of Invest in Innovation, or the mechanics of Tesla Stock Trading, hopefully you feel more comfortable now talking about it with your friends (or to yourself) in real life.

Conclusion: Why This Matters and What to Do Next

Alright, time to wrap this up. Thinking about diving into Tesla? Whether you decide to Invest in Innovation straight into TSLA stock, go via an ETF, or just follow the journey from afar—this is your welcome. That platform I mentioned? Seriously worth checking out: it’s beginner-friendly, supports fractional Tesla shares, gives you tools and education, and helps you track everything in one place.

So here’s the ask: go visit that site. Sign up, look around, maybe grab a small fraction of Tesla shares or participate in a clean-energy fund. Start learning. If it clicks, maybe scale up over time. And if you’re just curious? That’s fine, too. It’s a great place to explore Tesla Stock Trading and how to Invest in Innovation with confidence. Consider it your laid-back first step into an exciting future.

❓ Frequently Asked Questions (5 FAQs)

1. Can I start investing in Tesla with just a small amount of money?

Absolutely! Thanks to fractional shares, you can buy a part of a Tesla share even if its full price is high. Typical minimums might be $1, $5, or $10 on many platforms.

2. Is Tesla stock trading risky?

Yes, Tesla Stock Trading can be volatile. Prices can swing based on earnings, competition, news, or even tweets. It’s wise to only invest what you can afford to lose or hold long term.

3. What does “invest in innovation” really mean when investing in Tesla?

It means you’re backing companies that are developing new technologies—electric vehicles, clean energy, solar, battery storage. Tesla is one key example, but you can also diversify across similar innovators.

4. Should I trade Tesla frequently or hold long term?

That depends on your comfort and goals. Holding long term (“HODL”) is simpler and less work. If you prefer shorter‑term trading, be prepared to monitor news, earnings, and price movements frequently.

5. How do I compare Tesla’s performance with other green‑tech investments?

Use tools on the platform to compare TSLA’s metrics—like revenue growth, margins, price/earnings ratio—against other companies or ETFs in the sustainability or EV space. Many platforms include charts, analyst reports, or summary dashboards.

That’s it! Hope you enjoyed this friendly‑chat article about Tesla, Tesla Stock Trading, and how to Invest in Innovation. Dive in when you’re ready—looking forward to hearing how it goes!